Total nonfarm payroll employment rose by 1.4 million in August, and the unemployment rate fell to

8.4 percent, the U.S. Bureau of Labor Statistics reported today. These improvements in the labor

market reflect the continued resumption of economic activity that had been curtailed due to the

coronavirus (COVID-19) pandemic and efforts to contain it. In August, an increase in government

employment largely reflected temporary hiring for the 2020 Census. Notable job gains also

occurred in retail trade, in professional and business services, in leisure and hospitality, and

in education and health services.

This news release presents statistics from two monthly surveys. The household survey measures

labor force status, including unemployment, by demographic characteristics. The establishment

survey measures nonfarm employment, hours, and earnings by industry. For more information about

the concepts and statistical methodology used in these two surveys, see the Technical Note.

Household Survey Data

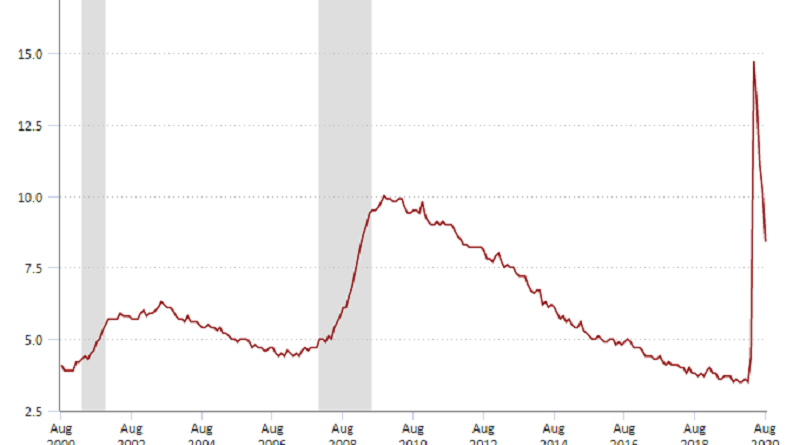

In August, the unemployment rate declined by 1.8 percentage points to 8.4 percent, and the number

of unemployed persons fell by 2.8 million to 13.6 million. Both measures have declined for 4

consecutive months but are higher than in February, by 4.9 percentage points and 7.8 million,

respectively. (See table A-1. For more information about how the household survey and its

measures were affected by the coronavirus pandemic, see the box note at the end of this news

release.)

Among the major worker groups, the unemployment rates declined in August for adult men (8.0

percent), adult women (8.4 percent), teenagers (16.1 percent), Whites (7.3 percent), Blacks (13.0

percent), and Hispanics (10.5 percent). The jobless rate for Asians (10.7 percent) changed

little over the month. (See tables A-1, A-2, and A-3.)

Among the unemployed, the number of persons on temporary layoff decreased by 3.1 million in

August to 6.2 million, down considerably from the series high of 18.1 million in April. In August,

the number of permanent job losers increased by 534,000 to 3.4 million; this measure has risen by

2.1 million since February. The number of unemployed reentrants to the labor force declined by

263,000 to 2.1 million. (Reentrants are persons who previously worked but were not in the labor

force prior to beginning their job search.) (See table A-11.)

The number of unemployed persons who were jobless less than 5 weeks decreased by 921,000 to 2.3

million in August, and the number of persons jobless 5 to 14 weeks fell by 2.0 million to 3.1

million. The long-term unemployed (those jobless for 27 weeks or more) numbered 1.6 million,

little changed over the month. (See table A-12.)

The labor force participation rate increased by 0.3 percentage point to 61.7 percent in August

but is 1.7 percentage points below its February level. Total employment, as measured by the

household survey, rose by 3.8 million in August to 147.3 million. The employment-population ratio

rose by 1.4 percentage points to 56.5 percent but is 4.6 percentage points lower than in

February. (See table A-1.)

In August, the number of persons who usually work full time rose by 2.8 million to 122.4 million,

and the number who usually work part time increased by 991,000 to 25.0 million. Part-time

workers accounted for about one-fourth of the over-the-month employment gain. (See table A-9.)

The number of persons employed part time for economic reasons (sometimes referred to as

involuntary part-time workers) declined by 871,000 to 7.6 million in August, reflecting a decrease

in the number of people who worked part time due to slack work or business conditions (-1.1

million). The number of involuntary part-time workers is 3.3 million higher than in February.

These individuals, who would have preferred full-time employment, were working part time because

their hours had been reduced or they were unable to find full-time jobs. This group includes

persons who usually work full time and persons who usually work part time. (See table A-8.)

In August, the number of persons not in the labor force who currently want a job declined by

747,000 to 7.0 million; this measure is 2.0 million higher than in February. These individuals

were not counted as unemployed because they were not actively looking for work during the last 4

weeks or were unavailable to take a job. (See table A-1.)

Among those not in the labor force who currently want a job, the number of persons marginally

attached to the labor force, at 2.1 million, changed little in August. These individuals had not

actively looked for work in the 4 weeks preceding the survey but wanted a job, were available

for work, and had looked for a job sometime in the prior 12 months. The number of discouraged

workers, a subset of the marginally attached who believed that no jobs were available for them,

decreased by 130,000 in August to 535,000. (See Summary table A.)

Household Survey Supplemental Data

In August, 24.3 percent of employed persons teleworked because of the coronavirus pandemic, down

from 26.4 percent in July. These data refer to employed persons who teleworked or worked at home

for pay at some point in the last 4 weeks specifically because of the coronavirus pandemic.

In August, 24.2 million persons reported that they had been unable to work because their

employer closed or lost business due to the pandemic–that is, they did not work at all or

worked fewer hours at some point in the last 4 weeks due to the pandemic. This measure is down

from 31.3 million in July. Among those who reported in August that they were unable to work

because of pandemic-related closures or lost business, 11.6 percent received at least some pay

from their employer for the hours not worked.

About 5.2 million persons not in the labor force in August were prevented from looking for work

due to the pandemic. This is down from 6.5 million in July. (To be counted as unemployed, by

definition, individuals must either be actively looking for work or on temporary layoff.)

These supplemental data come from questions added to the household survey beginning in May to

help gauge the effects of the coronavirus pandemic on the labor market. The data are not

seasonally adjusted. Tables with estimates from the supplemental questions for all months are

available online at www.bls.gov/cps/effects-of-the-coronavirus-covid-19-pandemic.htm.

Establishment Survey Data

Total nonfarm payroll employment rose by 1.4 million in August, following increases of larger

magnitude in the prior 3 months. In August, nonfarm employment was below its February level by

11.5 million, or 7.6 percent. Government employment rose in August, largely reflecting temporary

hiring for the 2020 Census. Notable job gains also occurred in retail trade, in professional and

business services, in leisure and hospitality, and in education and health services. (See table

B-1. For more information about how the establishment survey and its measures were affected by

the coronavirus pandemic, see the box note at the end of this news release.)

Employment in government increased by 344,000 in August, accounting for one-fourth of the over-

the-month gain in total nonfarm employment. A job gain in federal government (+251,000) reflected

the hiring of 238,000 temporary 2020 Census workers. Local government employment rose by 95,000

over the month. Overall, government employment is 831,000 below its February level.

Retail trade added 249,000 jobs in August, with almost half the growth occurring in general

merchandise stores (+116,000). Notable gains also occurred in motor vehicle and parts dealers

(+22,000), electronics and appliance stores (+21,000), and miscellaneous store retailers

(+17,000). Employment in retail trade is 655,000 lower than in February.

In August, employment in professional and business services increased by 197,000. More than half

of the gain occurred in temporary help services (+107,000). Architectural and engineering

services (+14,000), business support services (+13,000), and computer systems design and related

services (+13,000) also added jobs over the month. Employment in professional and business

services is 1.5 million below its February level.

Employment in leisure and hospitality increased by 174,000 in August, with about three-fourths

of the gain occurring in food services and drinking places (+134,000). Despite job gains

totaling 3.6 million over the last 4 months, employment in food services and drinking places is

down by 2.5 million since February.

In August, employment in education and health services increased by 147,000 but is 1.5 million

below February’s level. Health care employment increased by 75,000 over the month, with gains in

offices of physicians (+27,000), offices of dentists (+22,000), hospitals (+14,000), and home

health care services (+12,000). Elsewhere in health care, job losses continued in nursing and

residential care facilities (-14,000). Employment in private education rose by 57,000 over the

month.

Employment in transportation and warehousing rose by 78,000 in August, with gains in warehousing

and storage (+34,000), transit and ground passenger transportation (+11,000), and truck

transportation (+10,000). Employment in transportation and warehousing is down by 381,000 since

February.

The other services industry added 74,000 jobs in August, reflecting gains in membership

associations and organizations (+31,000), repair and maintenance (+29,000), and personal and

laundry services (+14,000). Employment in other services is 531,000 lower than in February.

Financial activities added 36,000 jobs in August, with most of the growth in real estate and

rental and leasing (+23,000). Employment in financial activities is down by 191,000 since

February.

In August, manufacturing employment rose by 29,000, with gains concentrated in the nondurable

goods component (+27,000). Despite gains in recent months, employment in manufacturing is

720,000 below February’s level.

Employment in wholesale trade increased by 14,000 in August, reflecting an increase of 9,000

in the nondurable goods component. Wholesale trade employment has declined by 328,000 since

February.

In August, employment changed little in mining, construction, and information.

In August, average hourly earnings for all employees on private nonfarm payrolls rose by 11

cents to $29.47. Average hourly earnings of private-sector production and nonsupervisory

employees increased by 18 cents to $24.81, following a decrease of 10 cents in the prior month.

The large employment fluctuations over the past several months–especially in industries with

lower-paid workers–complicate the analysis of recent trends in average hourly earnings. (See

tables B-3 and B-8.)

The average workweek for all employees on private nonfarm payrolls increased by 0.1 hour to

34.6 hours in August. In manufacturing, the workweek rose by 0.3 hour to 40.0 hours, and

overtime increased by 0.1 hour to 3.0 hours. The average workweek for production and

nonsupervisory employees on private nonfarm payrolls was unchanged at 34.0 hours. (See tables

B-2 and B-7.)

The change in total nonfarm payroll employment for June was revised down by 10,000, from

+4,791,000 to +4,781,000, and the change for July was revised down by 29,000, from +1,763,000

to +1,734,000. With these revisions, employment in June and July combined was 39,000 less than

previously reported. (Monthly revisions result from additional reports received from businesses

and government agencies since the last published estimates and from the recalculation of

seasonal factors.)

_____________

The Employment Situation for September is scheduled to be released on Friday, October 2, 2020,

at 8:30 a.m. (ET).

Full Report